Corporate Governance

The Company has established a corporate governance system suited to the businesses of the NIPPON STEEL Group in order to achieve the sound and sustainable growth of the NIPPON STEEL Group and increase its corporate value over the medium- to long-term, in response to the delegation of responsibilities by and trust of all stakeholders, including its shareholders and business partners.

Basic Structure of Corporate Governance

Policy on Strategic Shareholdings

Board Policies and Procedures in Determining the Compensation of Directors

Independence Standards of Independence Directors

Outside Director's Relationship with NIPPON STEEL

The Evaluation of the Effectiveness of the Board of Directors

Corporate Governance Report

Basic Structure of Corporate Governance

1.Reasons for Adopting a Company with an Audit & Supervisory Committee

The Company has adopted a company structure with an Audit & Supervisory Committee for the purpose of, among others, expediting management decision-making, enhancing discussions by the Board of Directors relating to matters such as the formulation of management policies and strategies by limiting the number of items for deliberation by the Board of Directors, and strengthening the supervisory function of the Board of Directors over management.

2.Corporate Governance System

Currently, the Board of Directors of NIPPON STEEL is comprised of fifteen (15) members, of whom ten (10) are Directors (excluding Directors who are Audit & Supervisory Committee Members) and five (5) are Directors who are Audit & Supervisory Committee Members. By all Directors appropriately fulfilling their respective roles and responsibilities, prompt decision-making is achieved corresponding to changes in the management environment, and multifaceted deliberations and objective and transparent decision-making by the Board of Directors are secured. In addition, Directors who are Audit & Supervisory Committee Members have voting rights on the Board of Directors regarding decisions on proposals for the election and dismissal of Directors as well as the election and dismissal of Representative Directors, and other decisions in general regarding business execution (excluding decisions that have been delegated to Directors). The Audit & Supervisory Committee has the authority to give its opinions at the General Meeting of Shareholders regarding the election, compensation, etc. of Directors, excluding Directors who are Audit & Supervisory Committee Members. This structure strengthens the supervisory function of the Board of Directors over management.

In accordance with a provision in the Articles of Incorporation, the Board of Directors of NIPPON STEEL delegates part of the decisions regarding execution of important operations (excluding matters listed in each item of Article 399-13, Paragraph 5 of the Companies Act) to the Representative Director and Chairman and Representative Director and President, thereby expediting management decision-making, and limiting the number of items for deliberation by the Board of Directors and enhancing discussions by the Board of Directors relating to matters such as the formulation of management policies and strategies. In order for all Outside Directors to obtain the necessary information and sufficiently fulfill their roles, the Chairman, the President and other senior management regularly hold meetings with all Outside Directors to share the management challenges and exchange opinions.

Independent Outside Directors account for one-third (5 out of 15) of all members of the Company’s Board of Directors.

(Board of Directors’ structure)

*If you are viewing this document on a smartphone, swipe to the sides to flip the pages.

[Directors (excluding Directors who are Audit & Supervisory Committee Members)]

- Outside:Outside Directors

- Independent:Independent Director

| Position | Name | Attendance rate |

|---|---|---|

| Representative Director, Chairman and CEO | Eiji Hashimoto | 100% |

| Representative Director, President and COO | Tadashi Imai | 100% |

| Representative Director, Vice Chairman and Executive Vice President | Takahiro Mori | 100% |

| Representative Director and Executive Vice President | Naoki Sato | 100% |

| Representative Director and Executive Vice President | Takashi Hirose | 100% |

| Representative Director and Executive Vice President | Kazuhisa Fukuda | 100% *1 |

| Representative Director and Executive Vice President | Hirofumi Funakoshi | 100% *1 |

| Representative Director and Executive Vice President | Hiroyuki Minato | -*2 |

| Director Outside Independent | Tetsuro Tomita | 100% |

| Director Outside Independent | Kuniko Urano | 100% |

[Directors who are Audit & Supervisory Committee Members]

- Outside:Outside Directors

- Independent:Independent Director

| Position | Name | Attendance rate |

|---|---|---|

| Senior Audit & Supervisory Committee Member (full-time) | Kazumasa Shinkai | -*2 |

| Senior Audit & Supervisory Committee Member (full-time) | Eiji Sogoh | -*2 |

| Audit & Supervisory Committee Member Outside Independent | Kenji Hiramatsu | -*2 |

| Audit & Supervisory Committee Member Outside Independent | Aiko Sekine | -*2 |

| Audit & Supervisory Committee Member Outside Independent | Sumiko Takeuchi | -*2 |

*1: Status of attendance at the 11 meetings of the Board of Directors held since his/her appointment.

*2: Appointed on June 21, 2024.

3.Establishment and Operation of the Internal Control System

To comply with applicable laws and regulations, and ensure the integrity of financial reports and the effectiveness and efficiency of business and affairs, NIPPON STEEL establishes and appropriately operates an internal control system, and strives to continually improve it. To create a sound and open organization, NIPPON STEEL establishes the internal control environment by emphasizing dialogue in and outside the workplace, regularly conducting attitude surveys with all employees, and establishing a whistleblower system to receive consultation and reports from officers and employees of NIPPON STEEL and the Group companies, as well as their families and others.

Internal Controls and Risk Management System

4.Appropriate Information Disclosure

To enhance management transparency and advance a correct understanding by stakeholders on the management situation of the Group, NIPPON STEEL not only seeks to disclose information in accordance with applicable laws and regulations and the rules of financial instruments exchanges on which NIPPON STEEL is listed, but also seeks to disclose financial and non financial information at an appropriate timing, in an easily understandable manner, and accurately.

5.Regular Examination and Review of Corporate Governance

NIPPON STEEL regularly examines and reviews, at the Board of Directors, the corporate governance structure, its operating situation, and other relevant facts and circumstances, including the analysis and evaluation of the effectiveness of the Board of Directors as a whole so that NIPPON STEEL will be able to make improvements autonomously, considering the opinions of Outside Directors. For the specific initiatives and situations regarding the NIPPON STEEL’s corporate governance, please see each item of this report.

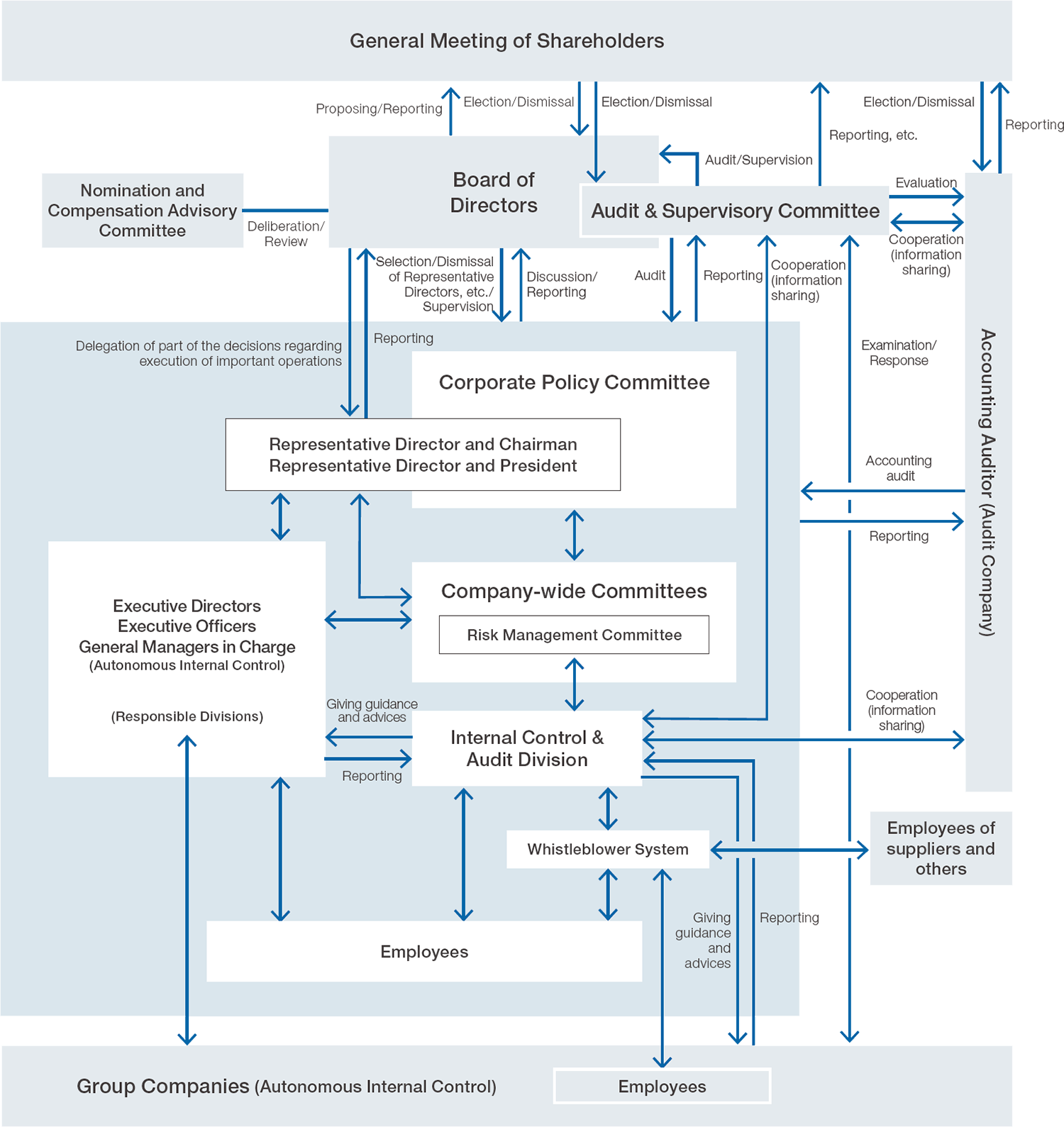

Relationship Diagram

The following is a diagram illustrating the relationship regarding NIPPON STEEL’s organization and internal control.

*If you are viewing this document on a smartphone, enlarge the figure and use it.

Board of Directors

The Board of Directors is comprised of fifteen (15) members, of whom ten (10) are Directors (excluding Directors who are Audit & Supervisory Committee Members) and five (5) are Directors who are Audit & Supervisory Committee Members. Outside Directors account for one-third (5 out of 15) of all members of the Company’s Board of Directors.

By all Directors appropriately fulfilling their respective roles and responsibilities, prompt decision-making is achieved corresponding to changes in the management environment, and multifaceted deliberations and objective and transparent decision-making by the Board of Directors are secured. In addition, Directors who are Audit & Supervisory Committee Members have voting rights on the Board of Directors regarding decisions on proposals for the election and dismissal of Directors as well as on election and dismissal of Representative Directors, and other decisions in general regarding business execution (excluding decisions that have been delegated to Directors). The Audit & Supervisory Committee has the authority to give its opinions at the General Meeting of Shareholders regarding the election, compensation, etc. of Directors, excluding Directors who are Audit & Supervisory Committee Members. This structure strengthens the supervisory function of the Board of Directors over management.

Furthermore, the Board of Directors delegates part of the decisions regarding execution of important operations (excluding matters listed in each item of Article 399-13, Paragraph 5 of the Companies Act) to the Representative Director and Chairman and Representative Director and President, thereby expediting management decision-making, while enhancing discussions by the Board of Directors relating to matters, such as the formulation of management policies and strategies, important business strategic issues, safety, environmental issues, disaster prevention, and quality assurance.

Audit & Supervisory Committee

The Audit & Supervisory Committee acts with the obligation of contributing to the establishment of a high-quality corporate governance system that enables sound and sustainable growth of NIPPON STEEL and its Group companies, by supervising the performance of responsibilities by Directors and acting as part of the Company’s oversight function, as an independent organ fulfilling its roles and responsibilities that are recently expected, in response to the delegation of responsibilities by the shareholders, and social trust.

Nomination and Compensation Advisory Committee

The “Nomination and Compensation Advisory Committee”, comprised of the Chairman, the President, and three or more members designated by the President, who is the Chairperson, from among the Outside Directors, has been established to conduct discussions and deliberations on a wide range of topics relating to the nomination and compensation of the Directors in general, including the compositions of the entire Board of Directors and the Audit & Supervisory Committee, the system and levels of the Directors› compensation, and other topics.

The Nomination and Compensation Advisory Committee comprises five members, the Representative Director and Chairman, Eiji Hashimoto, the Representative Director and President, Tadashi Imai, and Outside Directors Tetsuro Tomita, Kuniko Urano and Kenji Hiramatsu. The President serves as the chairman of the Committee. The Nomination and Compensation Advisory Committee, as a general rule, is held twice a year (in fiscal year 2024, held in May and scheduled in December).

Corporate Policy Committee

The Corporate Policy Committee comprises the Representative Director and Chairman, Representative Director and President, Representative Directors and Executive Vice Presidents, and other members, and is held once a week, in principle. The execution of important matters concerning the management of NIPPON STEEL and the NIPPON STEEL Group is determined at the Board of Directors after deliberations in the Corporate Policy Committee.

In addition, NIPPON STEEL has introduced an Executive Officer system for setting clear responsibilities and improving management efficiency by more prompt decision-making.

Company-wide committees

As corporate organizations engaging in deliberations before the Corporate Policy Committee and the Board of Directors, there are 23 company-wide committees in total, including the Ordinary Budget Committee, the Plant and Equipment Investment Budget Committee, the Investment and Financing Committee, the Fund Management Committee, the Technology Development Committee, the Environmental Planning Committee, the Risk Management Committee, and the Green Transformation Development Committee, depending on each purpose (as of April 1, 2024).

Policy on Strategic Shareholdings

1.Policy on Strategic Shareholdings

NIPPON STEEL, from the standpoint of sustainable growth and improvement of its corporate value in the mid- to long-term, believes that it is extremely important to maintain and develop the relationships of trust and alliance with its extensive range of business partners and alliance partners both in Japan and overseas, which have been cultivated through its business activities over the years. Accordingly, NIPPON STEEL shall continue to hold strategic shareholdings which are judged to contribute to maintaining and strengthening its business foundation such as the business relationships and alliance relationships between NIPPON STEEL and the investees, enhancing the profitability of both parties, and thereby improving the corporate value of NIPPON STEEL and the Group. Regarding companies for which we confirm to be able to achieve the objectives described above without holding their shares after sufficient dialogues, we will proceed with the sale of shares in such companies.

2.Examination of the Appropriateness of the Strategic Shareholdings

NIPPON STEEL confirms the appropriateness of its strategic shareholdings by specifically examining all shareholdings to determine, among others, whether the purpose of each shareholding is appropriate and whether the benefit and risk associated with each shareholding are commensurate with the cost of capital. Of these shareholdings, each shareholding with the market value exceeding a certain threshold is examined each year at the Board of Directors. The total market value of the shareholdings examined at the Board of Directors accounts for approximately 90% of the total market value of the strategic shareholdings held by NIPPON STEEL on a consolidated basis (as of March 31, 2024).

The number of stocks held as strategic shareholdings by NIPPON STEEL on a nonconsolidated basis was 252, as of March 31, 2024 (total value on the balance sheet was 269.7 billion yen), while 495 were held as of October 1, 2012, when Nippon Steel & Sumitomo Metal Corporation was founded.

3.Basic Policy on Exercise of Voting Rights Concerning Strategic Shareholdings

Regarding the voting rights concerning each strategic shareholding, NIPPON STEEL exercises its voting rights upon comprehensively evaluating whether the agenda of the General Meeting of Shareholders of the investee company contributes to the improvement of the respective corporate values of NIPPON STEEL and the investee company.

Specifically, NIPPON STEEL formulates criteria for the exercise of voting rights which set forth guidelines for judgment according to the type of agenda items such as the appropriation of surplus, the election of Directors and Audit & Supervisory Board Members, etc., and exercises its voting rights based on these criteria together with the results of the examination of the appropriateness of the strategic shareholdings mentioned above.

Board Policies and Procedures in Determining the Compensation of Directors

1.Content of policies

The policies regarding the decisions on the amount of compensation, etc. for Directors of NIPPON STEEL are as detailed in the following (a) and (b) below.

NIPPON STEEL abolished its retirement benefits for Directors in 2006. Furthermore, the policies relating to their bonuses were removed from the "Policies regarding the Decisions on the Amount of Compensation" for Directors, etc. in 2013.

(a) Directors (excluding Directors who are Audit & Supervisory Committee Members)

a)Basic policy

The amount of compensation for Directors (excluding Directors who are Audit & Supervisory Committee Members) consists solely of monthly compensation, set based on an appropriate composition of fixed compensation and performance-linked compensation. NIPPON STEEL sets the base amount of fixed and performance-linked compensation (i.e., the amount of compensation when the Company’s consolidated performance reaches a certain level) for each position in consideration of compensation level commensurate with the skills and responsibilities required. The amount of performance-linked compensation is changed within a certain range based on the Company’s consolidated performance. The Company then determines the amount of monthly compensation for each Director is determined within the limited amount approved by the General Meeting of Shareholders.

b)Policy on performance-linked compensation

In accordance with “a) Basic policy” above, as indicators for performance-linked compensation for Directors (excluding Directors who are Audit & Supervisory Committee Members and Outside Directors), the Company uses consolidated underwriting profit/loss based on actual performance (which is consolidated profit/loss excluding inventory valuation impact and other items, and recognized as representing the Group’s actual profitability) in order to set an appropriate compensation commensurate with performance for the corresponding term, while taking into account other factors including the revenue targets in the medium- to long-term management plan. The ratio of fixed compensation to performance-linked compensation at the base amount (when consolidated underlying profit/loss reaches 600.0 billion yen) is set at 50% to 50% for Representative Directors. and approximately 70% to 30% for Directors in other positions (excluding Directors who are Audit & Supervisory Committee Members and Outside Directors), to provide appropriate incentives according to their position and performance.

Compensation for Outside Directors (excluding Directors who are Audit & Supervisory Committee Members) consists solely of fixed compensation.

c)Method to determine compensation for each individual

The specific amount of monthly compensation for each Director (excluding Directors who are Audit & Supervisory Committee Members) is determined by the Board of Directors after deliberation by the Nomination and Compensation Advisory Committee consisting of the Chairman, the President, and three (3) or more Outside Directors appointed by the President who serves as the chairman of the committee.

(b) Directors who are Audit & Supervisory Committee Members

Compensation for Directors who are Audit & Supervisory Committee Members consists solely of fixed monthly compensation. The Company determines the amount of monthly compensation for each Director within the limited amount approved by the General Meeting of Shareholders by considering the duties of the Director’s position and whether the Director is full-time or part-time.

2.Methods of determining the policies

The policies described in 1 above for Directors (excluding Directors who are Audit & Supervisory Committee Members) are determined by resolution of the Board of Directors, after the deliberation of the Nomination and Compensation Advisory Committee, while for Directors who are Audit & Supervisory Committee Members, the policies described in 1. Above are determined through discussion by Directors who are Audit & Supervisory Committee Members.

The Nomination and Compensation Advisory Committee conducts discussions on a wide range of topics including the system of Directors' compensation and the appropriateness of the compensation levels by position, taking into account the survey results of directors' compensation levels of other companies obtained from third-party research organizations.

Independence Standards of Independence Directors

NIPPON STEEL decides the independence of Outside Directors in accordance with the independence standards set by the financial instruments exchanges in Japan (e.g. Tokyo Stock Exchange), considering each individual’s personal relationship, capital relationship, business relationship, and other interests with NIPPON STEEL.

Outside Director's Relationship with NIPPON STEEL

*If you are viewing this document on a smartphone, swipe to the sides to flip the pages.

| Name | Reasons of Appointment |

|---|---|

| Tetsuro Tomita | 【Reasons for Appointment as an Outside Director】 NIPPON STEEL believes that Mr. Tomita is well-qualified for the position by his deep insight and ample experience in corporate management. 【Reasons for Designation as an Independent Director】 Until March 2018, Mr. Tomita engaged in the execution of business of East Japan Railway Company, which has a business relationship with NIPPON STEEL for transactions of steel and other products/services. However, he currently does not engage in the execution of its business. The amount of transactions with the said company accounts for less than 1% of the consolidated revenue of NIPPON STEEL, so that the said company is not a specified associated service provider of NIPPON STEEL. He does not conflict with the independence standards as set by each financial instruments exchange on which NIPPON STEEL is listed (e.g. Tokyo Stock Exchange), and does not have any special interests with NIPPON STEEL. Because NIPPON STEEL believes that there is no possibility of a conflict of interest between him and the general shareholders as stated above, NIPPON STEEL has designated him as an Independent Director. |

| Kuniko Urano | 【Reasons for Appointment as an Outside Director】 NIPPON STEEL believes that Ms. Urano is well-qualified for the position by her deep insight and ample experience in corporate management. 【Reasons for Designation as an Independent Director】 Until March 2021, Ms. Urano engaged in execution of business of Komatsu Ltd., which has a business relationship with NIPPON STEEL for transactions of steel and other products/services. However, she currently does not engage in the execution of its business. The amount of transactions with the said company accounts for less than 1% of the consolidated revenue of NIPPON STEEL, so that the said company is not a specified associated service provider of NIPPON STEEL. She does not conflict with the independence standards as set by each financial instruments exchange on which NIPPON STEEL is listed (e.g. Tokyo Stock Exchange), and does not have any special interests with NIPPON STEEL. Because NIPPON STEEL believes that there is no possibility of a conflict of interest between her and the general shareholders as stated above, NIPPON STEEL has designated her as an Independent Director. |

| Kenji Hiramatsu | 【Reasons for Appointment as an Outside Director】 NIPPON STEEL believes that Mr. Hiramatsu is well-qualified for the position by his deep insight regarding international affairs, economy, culture, etc., that he accumulated at the Ministry of Foreign Affairs as well as ample experience as Ambassador Extraordinary and Plenipotentiary and other important positions. 【Reasons for Designation as an Independent Director】 He does not conflict with either the independence standards or attribute information as set by each financial instruments exchange on which NIPPON STEEL is listed (e.g. the Tokyo Stock Exchange), and does not have any special interests in NIPPON STEEL. Because NIPPON STEEL believes that there is no possibility of a conflict of interest between him and the general shareholders as stated above, NIPPON STEEL has designated him as an Independent Director. |

| Aiko Sekine | 【Reasons for Appointment as an Outside Director】 NIPPON STEEL believes that Ms. Sekine is well-qualified for the position by reason of her deep insight as a certified public accountant possessing deep familiarity with corporate accounting, and her ample experience as a Partner of an audit corporation and Chairman and President of Japanese Institute of Certified Public Accountants and other important positions. 【Reasons for Designation as an Independent Director】 Ms. Sekine is a professor at Waseda University, Faculty of Commerce, and is engaged in the execution of business of the university. The Company conducts joint research with Waseda University, Faculty of Science and Engineering, and pays it, among others, contract research expenses, which account for less than 1% of the consolidated selling, general and administrative expenses of the Company. Therefore, the university is not a specified associated service provider of the Company. She does not conflict with the independence standards as set by each financial instruments exchange on which NIPPON STEEL is listed (e.g. the Tokyo Stock Exchange), and does not have any special interests in NIPPON STEEL. Because NIPPON STEEL believes that there is no possibility of a conflict of interest between her and the general shareholders as stated above, NIPPON STEEL has designated her as an Independent Director. |

| Sumiko Takeuchi | 【Reasons for Appointment as an Outside Director】 NIPPON STEEL believes that Ms. Takeuchi is well-qualified for the position by reason of the deep insight she has cultivated as a researcher in the fields of environment and energy at an NPO and universities, as well as her ample experience in corporate management. 【Reasons for Designation as an Independent Director】 She does not conflict with either the independence standards or attribute information as set by each financial instruments exchange on which NIPPON STEEL is listed (e.g. the Tokyo Stock Exchange), and does not have any special interests in NIPPON STEEL. Because NIPPON STEEL believes that there is no possibility of a conflict of interest between her and the general shareholders as stated above, NIPPON STEEL has designated her as an Independent Director. |

The Evaluation of the Effectiveness of the Board of Directors

At NIPPON STEEL, the office of the Board of Directors (General Administration Division) conducts quantitative analysis through comparison of the number of the agenda items submitted for deliberation or reported to the Board of Directors and the number of hours of deliberation, as well as the attendance rate and the number of opinions expressed by each of Directors at the meetings of the Board of Directors with these of prior years; and the Board of Directors, taking into account self-assessments and opinions of each member of the Board of Directors on the operation of the Board of Directors obtained through individual interviews with them, annually analyzes and evaluates the effectiveness of the entire Board of Directors and utilizes such analysis and evaluation to improve the future operation and administration of the Board of Directors. NIPPON STEEL decided to take the opportunity of the transition to a Company with an Audit & Supervisory Committee in fiscal year 2020 to establish the Rules of the Board of Directors, enhance discussions by the Board of Directors on matters such as the formulation of management policies and strategies, strengthen the supervisory function of the Board of Directors over management, and devise and improve operation of meetings so as to contribute to these efforts.

The Board of Directors, at its meeting held in June 2024, analyzed and evaluated the effectiveness of the Board of Directors for fiscal year 2023, confirming that the Board of Directors functions effectively because all of the matters submitted for deliberation or reported to the Board of Directors pursuant to the Companies Act or NIPPON STEEL’s rules were resolved or confirmed, after discussion among Inside and Outside Directors, from the point of view of improvement of NIPPON STEEL’s corporate value in the mid- to long-term or other various perspectives, with relevant information being provided in advance. In addition, from the standpoint of further enhancing the effectiveness of the Board of Directors, based on the opinions voiced by each Director in the effectiveness evaluation in fiscal year 2023, NIPPON STEEL will continue to improve the format and contents of materials for Board of Directors meetings, as well as the means of providing them, and enrich and revitalize deliberations by focusing on the subjects to be deliberated and reviewing the operation of the Board of Directors. In addition, NIPPON STEEL will continue to share a wide range of information such as on various environmental changes surrounding management, important long-term themes such as securing talents and supporting their participation and career advancement, matters related to risk management, and exchange opinions by actively using forums other than Board of Directors meetings.