Feb. 09, 2023

Nippon Steel Corporation

Nippon Steel Corporation announces that it has decided to issue a green bond

(unsecured straight corporate bond) in the Japanese market through a public offering and filed an Amended

Shelf Registration Statement for the Issuance of the Green Bond with the Kanto Local Finance Bureau on

February 9. The Bond will be issued to procure part of the funds needed to finance "production

facilities, research and development expenses, and other related expenditures for non-directional (NO)

electrical steel sheets used in eco-friendly car motors."

1. Background to the Issuance

The Nippon Steel Group is committed to "pursuing world-leading technologies and manufacturing

capabilities and contributing to society by providing excellent products and services" as stated in

its Corporate Philosophy. In order to play an important role in broadly supporting the foundation of

society through steelmaking, we have tackled a variety of issues. We believe that contributing to the

sustainable development of society through these efforts will also contribute to the achievement of the

United Nations Sustainable Development Goals (SDGs), which should be achieved globally by 2030.

Climate change is an important issue that affects the survival of humankind. In the medium- to long-term

management plan announced in March 2021, we identified our efforts concerning climate change as a

top priority management issue, and announced the Nippon Steel Carbon Neutral Vision 2050 as our own

initiative.

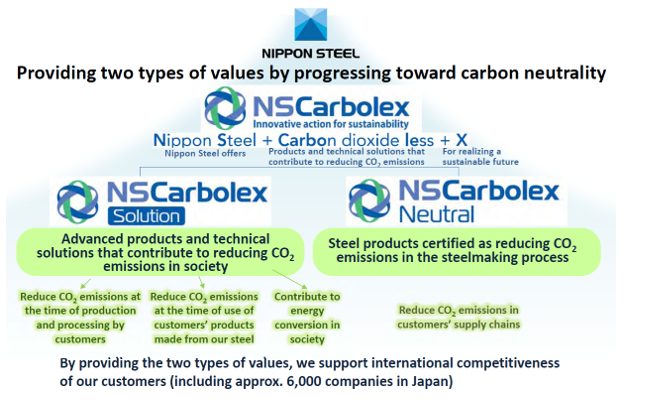

To achieve carbon neutrality by 2050, we aim to reduce CO2 emissions in the supply chain by providing two

values: Advanced products and technical solutions that contribute to reducing CO2 emissions in society

(NSCarbolexTM Solution) and steel products certified as reducing CO2 emissions in the

steelmaking process (NSCarbolexTM Neutral).

The proceeds of this issuance will be used to finance “production facilities,

research and development expenses, and other related expenditures for non-directional (NO) electrical

steel sheets for eco-friendly car motors,” which is part of the “advanced products and

technical solutions that contribute to reducing CO2 emissions in society (NSCarbolexTM

Solution).”

The world is rapidly moving toward decarbonization, and regulations for CO2 emissions and average fuel

economy for vehicles have been tightened. Amid that environment, demand for eco-friendly cars such as EVs

is accelerating and, with regard to NO electrical steel sheets used in the core of eco-friendly cars, the

need for higher-grade NO electrical steel sheets with less energy loss is anticipated to further

increase.

Nippon Steel was the first company to develop high-grade materials that are required to meet the

contradictory characteristics of low iron loss, high magnetic flux density, and high strength, and has

been steadily supplying them for eco-friendly cars for many years. We recognize that our customers highly

value our technological superiority and our competitiveness throughout the supply chain based on our

ability to steadily supply quality products, superior product shaping, and processability. This is why we

believe it is necessary for us to respond to further increases in demand.

By November 2021, we had already decided to invest a total of \123 billion in facilities to improve the

capacity and quality of electrical steel sheets in the Hirohata Area of Setouchi Works and the Yawata Area

of Kyushu Works, and we have been proceeding with construction. In the first half of fiscal 2024,

production capacity for electrical steel sheets is expected to increase 1.5 times from the current level,

and production of high-grade electrical steel sheets, in particular, is expected to increase 3.5

times.

We believe that responding to the growing demand and the need for higher-grade products through this

financing will contribute to our accelerated efforts to address climate change issues and the creation of

a sustainable society.

2.Outline of the Issuance

| Issuer |

Nippon Steel Corporation |

| Maturity of issuance |

TBD |

| Issuance amount |

TBD |

| Date of issuance |

March 2023 or later |

| Use of proceeds |

Funds for production facilities, research and development expenses, and other related

expenditures for non-oriented electrical steel sheets for eco-friendly car motors |

| Lead managing underwriters |

Mizuho Securities Co., Ltd. SMBC Nikko Securities Inc. Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. Nomura Securities Co., Ltd. Daiwa Securities Co., Ltd. |

| Structuring agent1 |

Mizuho Securities Co., Ltd. |

3. Formulation of a green bond framework and obtaining external evaluations

Nippon Steel has formulated the Nippon Steel Corporation Green Bond Framework2 in accordance

with the International Capital Market Association (ICMA)’s “Green Bond Principles 2021”

and the Ministry of the Environment's “Green Bond Guidelines 2022”.

The Framework has obtained a second-party opinion3 from Rating and Investment Information,

Inc., a third-party evaluation organization, stating that it complies with various standards for green

bond issuance.